- UCITS ETFs are increasingly favoured by investors as an efficient way to access fixed income, including US Treasuries, which offer defensive qualities during uncertain markets.

- Successful trading in US Treasury UCITS ETFs requires an understanding of underlying bond liquidity, transaction costs and the impact of trade size on execution.

- For favourable trading outcomes, investors should pay attention to timing, understand all aspects of ETF liquidity (for both the ETF itself and its underlying liquidity) and engage with well-connected counterparties.

The growing use of UCITS ETFs warrants improved understanding

Investors in the UK, Europe and offshore markets are increasingly turning to UCITS ETFs for efficient, diversified access to bond exposures, such as US Treasuries, thanks to the trusted UCITS structure. US Treasuries are highly valued for their defensive qualities, especially during periods of market volatility. Investors often look to US Treasuries for their perceived safety, liquidity and ability to provide portfolio ballast.

As global markets grow more connected, investing in fixed income through UCITS ETFs demands greater trading expertise. This is due to the liquidity profiles and transaction costs related to bond access, which are critical factors – especially when using UCITS ETFs, as highlighted in Bond ETFs and the total cost of ownership.

Underlying liquidity dynamics are key for fixed income ETFs

Investors considering an allocation to a US Treasury ETF would benefit from understanding the liquidity dynamics at play. The underlying liquidity of an ETF’s benchmark constituents is crucial for efficient trading, in particular when average daily volume (ADV)1 is low or the ETF is recently launched2. A common misconception is that low ADV equates to poor execution, but this isn’t necessarily true. While fewer shares may trade daily on the secondary market, ETF market makers3 can provide liquidity on demand, often via request for quote (RFQ) platforms4.

Market makers create or redeem shares through the primary market, sourcing the underlying securities directly from the ETF provider. Due to this mechanism, an ETF is typically at least as liquid as its underlying benchmark. This structure allows investors to access liquidity even when secondary market trading appears limited, making the ETF a practical tool for fixed income exposure.

ETF liquidity considerations: Equity versus fixed income

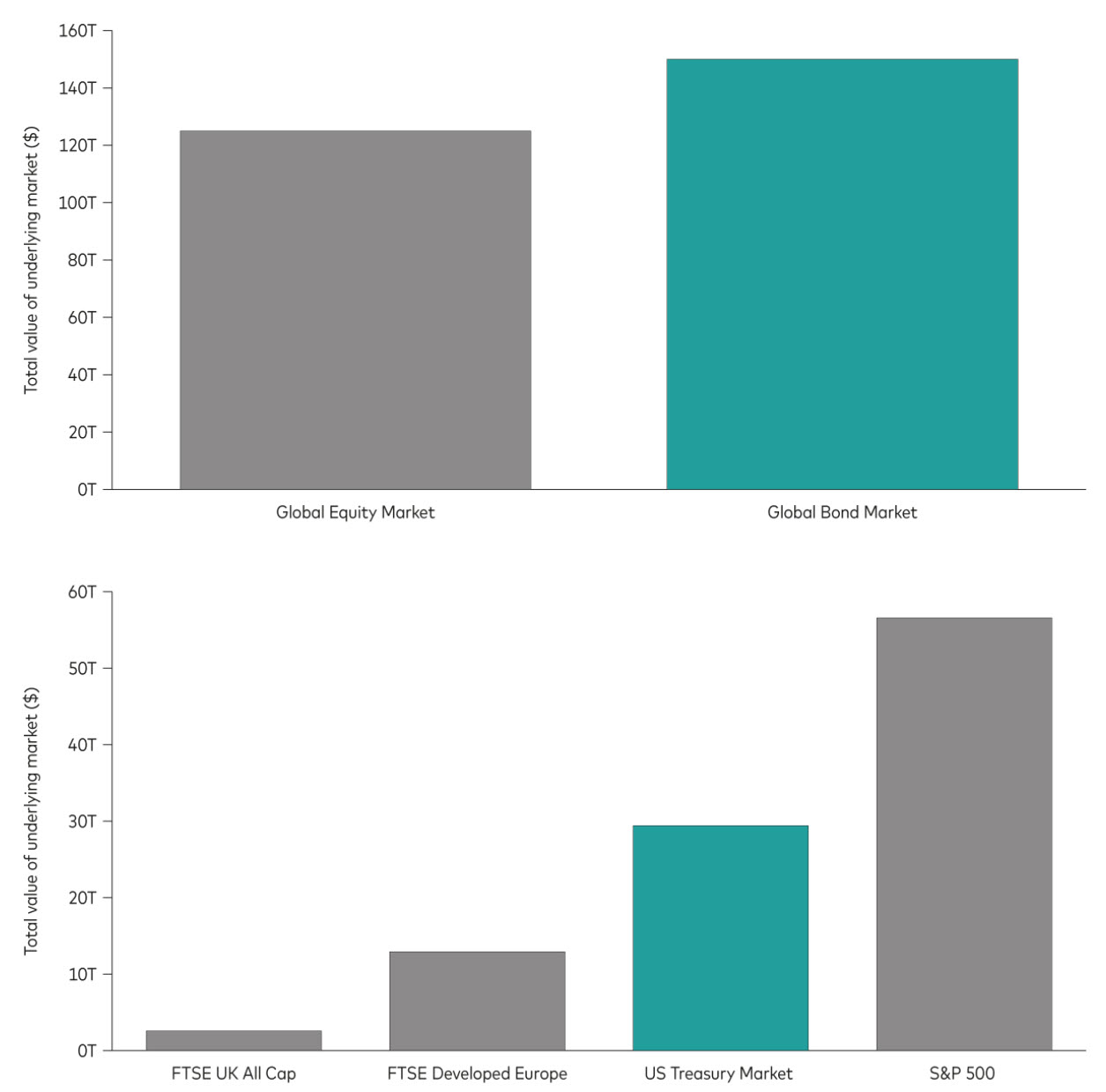

With equity ETFs, traded liquidity of the underlying securities is easier to quantify due to transparent reporting. In contrast, fixed income markets—especially over-the-counter (OTC)5, dealer-led markets such as US Treasuries—are fragmented, making liquidity harder to measure. To put this in context, the global fixed income market is the largest in the world, and the US Treasury market makes up a significant portion of this value.

Bonds account for a huge portion of benchmark values

Size of global bond market and US Treasury market relative to others

Sources: SIFMA for the overall equity and bond market sizes, as at December 2024. US Federal Reserve and Bloomberg for the US Treasury market and equity markets, respectively, as at September 2025.

As an example, consider a 1–3 year US Treasury ETF with a benchmark comprising 97 bonds. If an investor trades $1 billion of the ETF, the market maker may create $1 billion worth of shares by either transferring cash (relying on the ETF provider’s execution) or delivering bonds in-kind (using their own execution). Both the ETF provider and the market makers assess the cost of such a creation, which is passed on to the investor.

Costs can arise from tracking error and execution price versus benchmark – both factors are influenced by the underlying liquidity of the 97 bonds in the ETF’s benchmark. Unlike equities, US Treasuries carry less idiosyncratic risk, allowing ETFs to sample the index rather than fully replicate it. This helps avoid some of the more expensive bonds while maintaining duration and risk targets, making the ETF structure flexible and cost-efficient.

Metrics and trade size matter when considering a trade

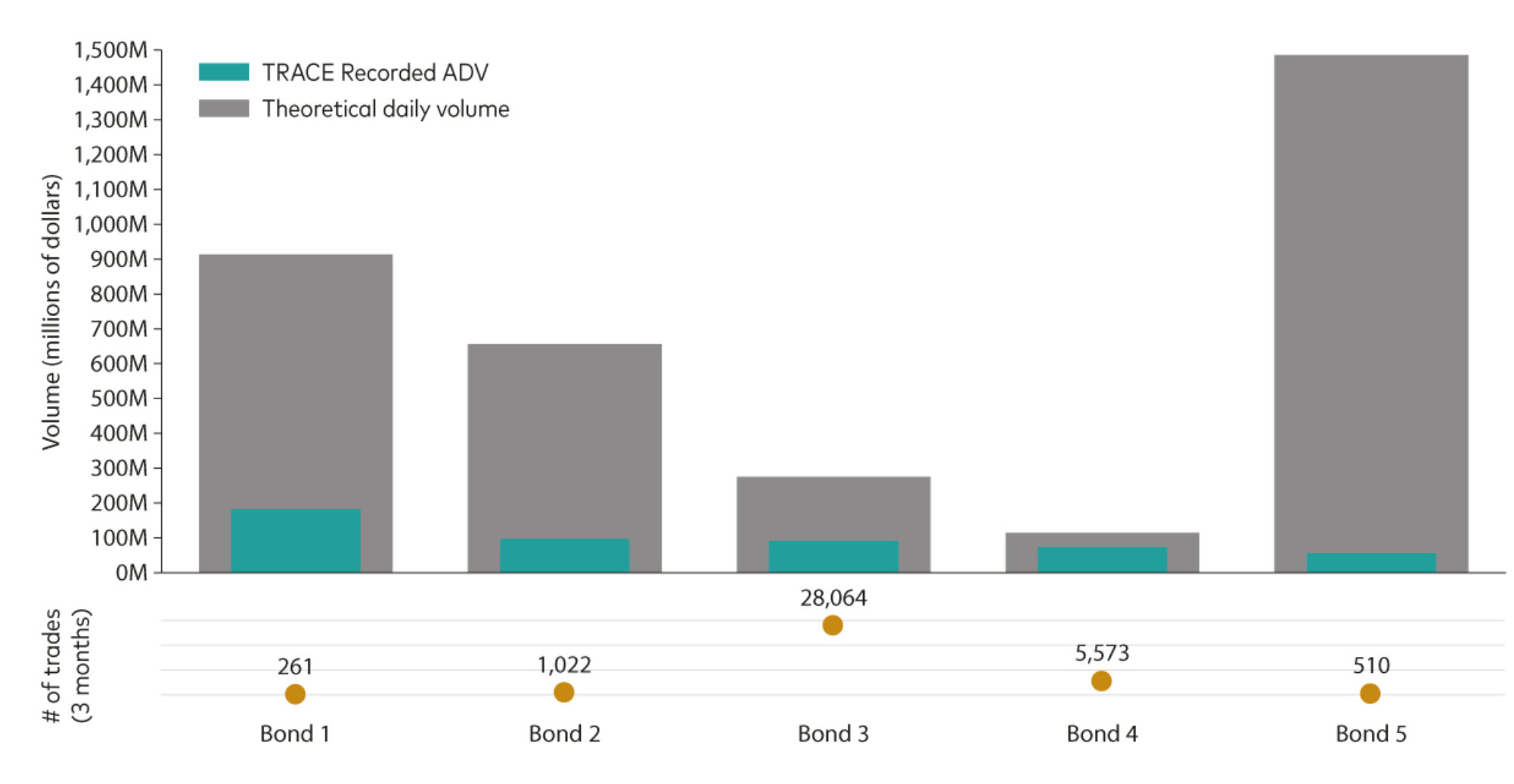

To identify what constitutes an “expensive” bond, market data is key. US Treasury trades are reported via TRACE6, but this doesn’t capture the full picture. Repos, dealer hedging and interdealer activity mean the actual liquidity is often higher than reported. A more realistic metric, which accounts for the activity not reported on TRACE, is theoretical traded value.

Assessing metrics of US Treasury liquidity

TRACE and the theoretical daily volume of 5 of the 97 bonds in a 1-3 year US Treasury index

Source: FINRA, Bloomberg, Vanguard, as at September 2025. The chart is provided for illustrative purposes only.

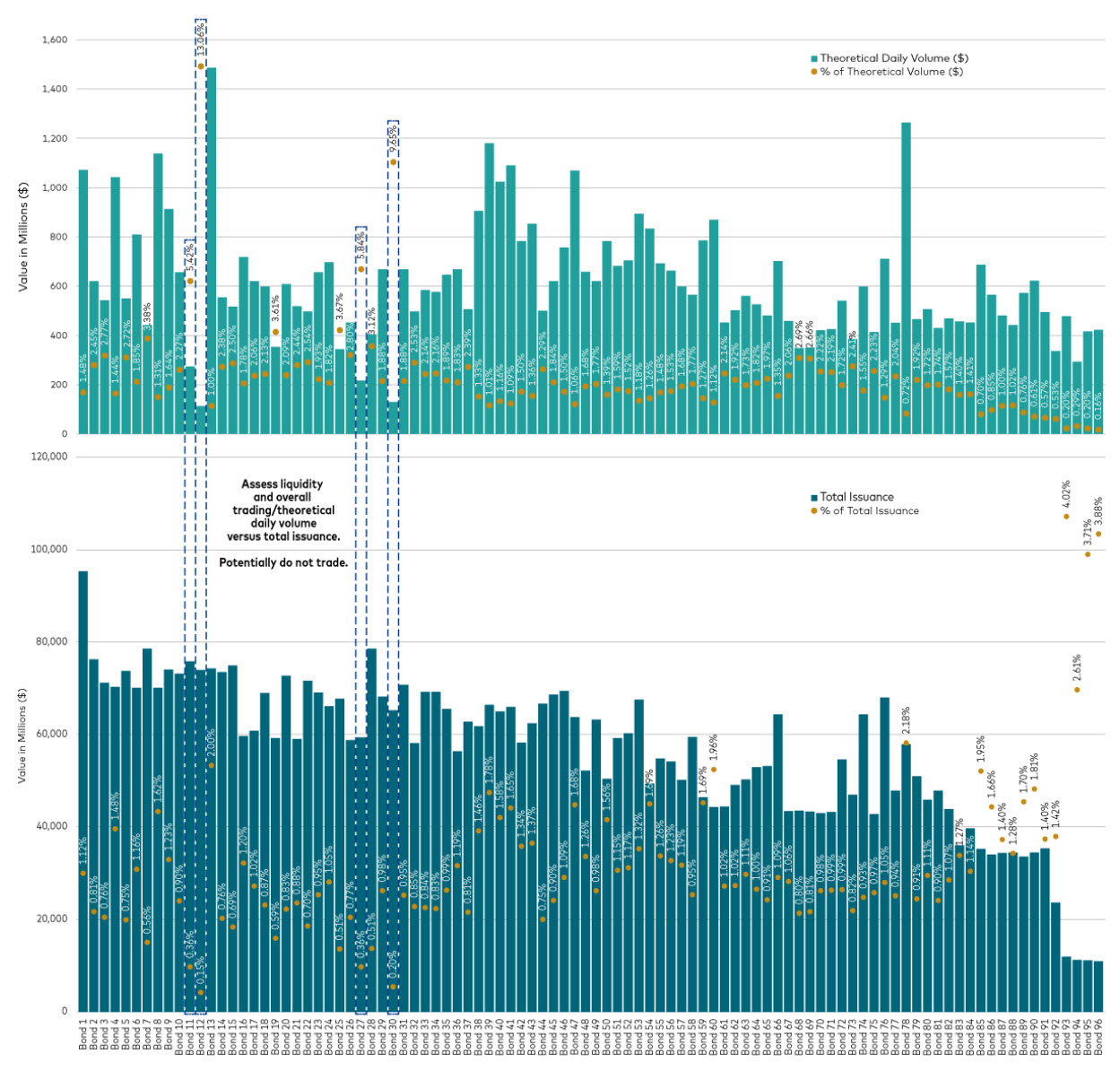

Issuers and market makers use a range of underlying liquidity metrics to gauge market impact and reduce costs that could be externalised to the end investor. If an investor’s ETF trade is large enough that one metric breaches a threshold (i.e., the traded value exceeds a certain percentage of theoretical value), another liquidity metric can be used, such as traded value versus bond issuance. If multiple of these metrics breach thresholds, it may be determined that costs borne from trading the bond will be too high or the bond may be untradable at that size.

Such a scenario could lead to an ETF trading outside of its basket spread7 and therefore further away from that ETF’s intraday fair value. Expanding on the 1-3 year US Treasury example, a single flow would need to exceed $1 billion before liquidity could become a potential concern. For trades below or around that size, even with low ADV, the execution outcome should not be hindered by liquidity, demonstrating the resilience of the ETF structure for most investors.

ETFs can accommodate large flows before liquidity becomes a concern

A closer look at theoretical daily volume, ADV and total bond issuance

Source: Bloomberg, Vanguard, as at September 2025. The chart is provided for illustrative purposes only.

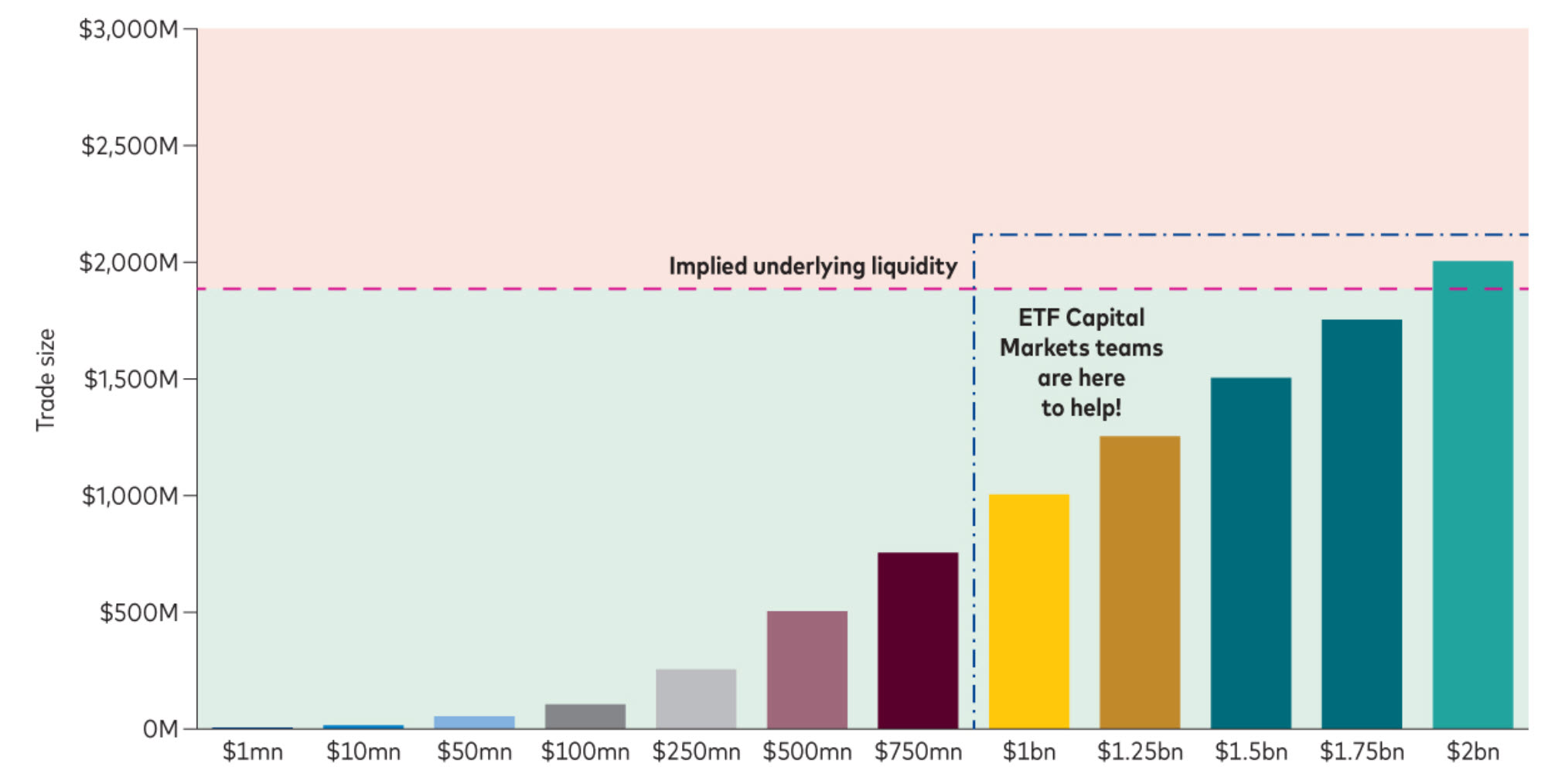

For trades reaching $1 billion, execution should remain smooth thanks to underlying bond liquidity and its role in the create/redeem process between authorised participants and issuers, such as Vanguard.

However, as single trade sizes become larger (i.e., trades within the blue lines in the chart below) and move closer to the total implied underlying liquidity8 for an ETF (circa $2 billion, or the red dotted line in the chart below), investors should consider whether additional insights could improve execution.

For optimal outcomes on larger trades, we recommend engaging with an ETF issuer’s capital markets team to help achieve the desired trading objectives. These objectives can vary by ETF, and capital markets teams are on hand to provide analytics and guidance.

Even at low ADV, smooth execution is possible

Capital markets teams can help to provide insights

Source: Vanguard, as at September 2025. The chart is provided for illustrative purposes only.

Best practices for bond ETF investors

When trading ETFs, always follow safe and established trading protocols. For guidance on trading fixed income ETFs of any size, including sizes that breach underlying liquidity thresholds, we recommend consulting with an ETF provider’s capital markets team. These teams can provide analysis and support to help you navigate the complexities of ETF trading.

For investors looking at placing a trade in a UCITS ETF, including US Treasury ETFs, three essential considerations are timing, liquidity and connectivity. Timing is particularly important as investors must pay attention to local market hours, especially when trading at larger sizes. Trading during market open hours for the underlying enables investors to minimise the risk of receiving wider pricing and a potentially higher total cost of ownership.

Liquidity should be assessed across all venues, not just on a single exchange. The trading of UCITS ETFs is fragmented, so total liquidity includes trading on all local exchanges, OTC trading and underlying liquidity. Lastly, connectivity with several counterparties active in the ETF’s primary market enhances the likelihood of receiving competitive pricing and efficient order fulfillment, ensuring clients get the best execution possible.

1 “Average daily volume” refers to the average number of shares or units of an ETF that are traded over a given period. ADV is a useful metric for investors and traders because it provides insight into the liquidity and trading activity of an ETF.

2 When an ETF is relatively new, it may not have amassed a large amount of assets – which would mean that a large trade (relative to the total assets) could potentially move the price of the ETF.

3 A “market maker” is a financial institution that provides liquidity to the market by continuously buying and selling securities, including ETFs. The market maker’s primary role is to ensure that there is always a buyer for a seller and a seller for a buyer, which helps to maintain a stable and efficient market.

4 “Request for quote” is a process used in financial markets, including ETF investing, where an investor or trader requests price quotes from one or more market participants, such as market makers or liquidity providers, before executing a trade.

5 “Over the counter”, in this context, refers to a decentralised market where bonds are traded directly between parties, rather than on a centralised exchange.

6 The Trade Reporting and Compliance Engine (“TRACE”) is the FINRA-developed vehicle that facilitates the mandatory reporting of over-the-counter transactions in eligible fixed income securities. All broker-dealers who are FINRA member firms have an obligation to report transactions in TRACE-eligible securities under an SEC-approved set of rules. Source: finra.org.

7 The “basket spread” is defined as the weighted average spread of the bonds in an ETF’s benchmark.

8 For example, this would be the ETF’s potential trading volume before significantly impacting the ETF’s price.

Important information

Shares of the Funds are only available for certain non-U.S. persons in select transactions outside the United States, or, in limited circumstances, otherwise in transactions which are exempt in reliance on Regulation S from the registration requirements of the United States Securities Act of 1933, as amended and such other laws as may be applicable. This document does not constitute an offer to subscribe for shares in the Fund. This document should not be provided to retail investors in the United States. In the United States, this document is directed at professional/sophisticated investors and is for their use and information. The offering or sale of Fund shares maybe restricted in certain jurisdictions.

All investing is subject to risk, which may result in loss of principal. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

Investments in bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Diversification does not ensure a profit or protect against a loss.

"Bloomberg®" and Bloomberg Indexes mentioned herein are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL"), the administrator of the index (collectively, "Bloomberg") and have been licensed for use for certain purposes by Vanguard. Bloomberg is not affiliated with Vanguard and Bloomberg does not approve, endorse, review, or recommend the Financial Products included in this document. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Financial Products included in this document.