About us

A different kind of investement firm

Our mission: To take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.

We believe four simple principles can improve your chances of investment success.

Think about goals

The best way to work toward an investment goal is to start by defining it clearly, take a level-headed look at the means of getting there, and then create a detailed, specific plan. This could be anything from saving for retirement, to buying a home.

Stay balanced

A sound investment strategy starts with an asset allocation suitable for the portfolio’s objective. The allocation should be built upon reasonable expectations for risk and returns and should use diversified investments to avoid exposure to unnecessary risks.

Keep costs low

Investors cannot control the markets, but they can often control what they pay to invest. The lower your costs, the greater your share of an investment’s return.

Maintain perspective and long-term discipline

Sometimes our emotions can lead us to make simple mistakes when investing. The most successful investors are often those who invest for the long term and don’t tinker with their portfolios too much.

Changing the way the world invests

The Vanguard effect comes to Offshore

Our client-focused approach is anchored in the ownership structure of The Vanguard Group. As a result, investors in the Americas benefit from Vanguard’s stability and experience, low costs, and client focus.

Providing low-cost investments isn't a pricing strategy for us. It's how we do business. A relentless mission to keep costs low

We listen carefully to our clients

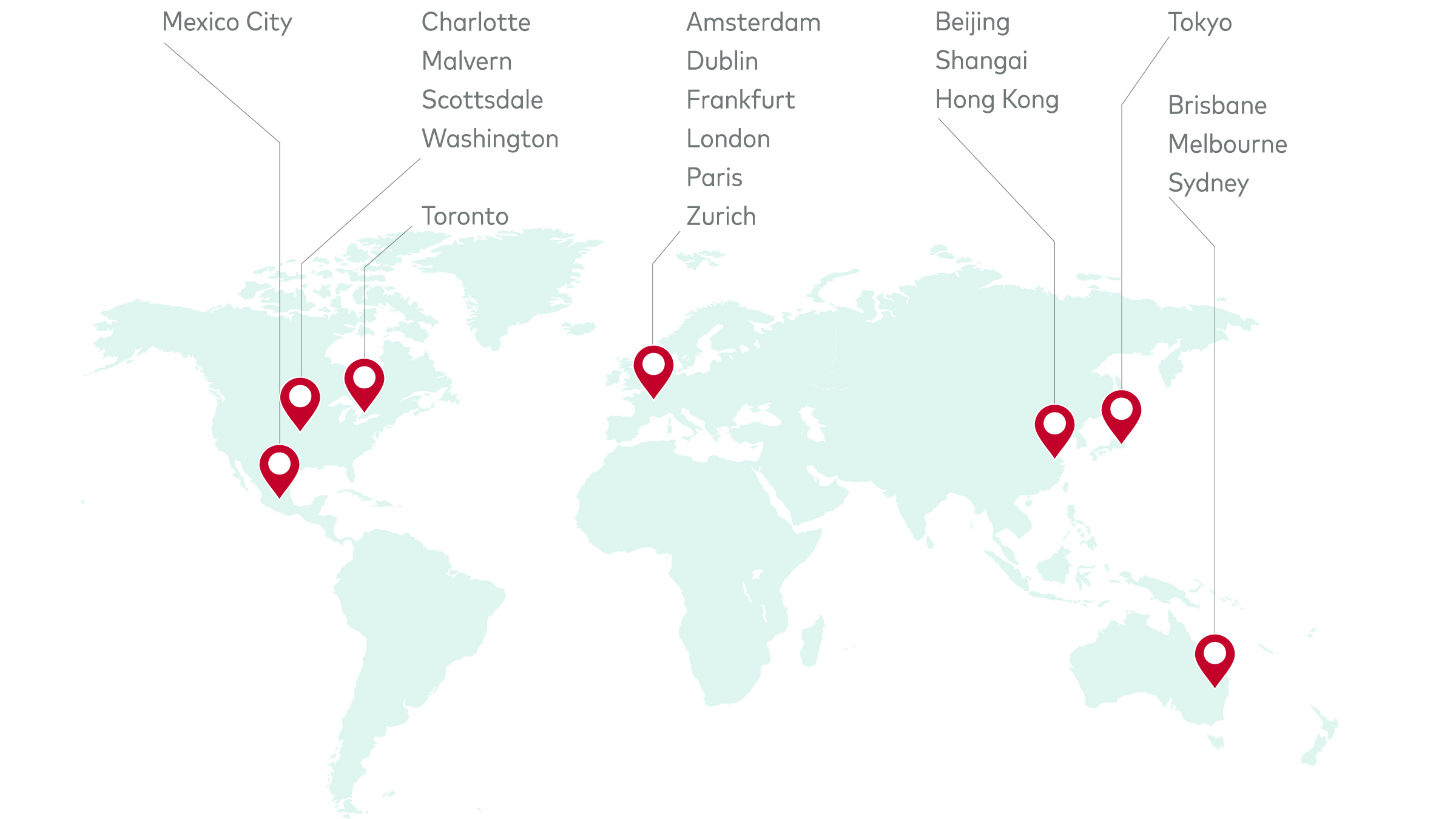

Aproach has earned us the trust of millions of investors and allowed us to become one of the world’s largest investment management companies, with a presence in Europe, Australia, and Asia as well as the Americas.

Providing low-cost investments isn't a pricing strategy for us. It's how we do business.

We believe in giving investors access to broadly diversified investment solutions at a low cost. The less you pay for investments, the more you get to keep from your potential returns.

Vanguard is owned by its U.S. mutual funds, which are owned by Vanguard's fund shareholder clients.

At Vanguard, we don’t have any outside owners, so we don’t need to worry about a stock price or about generating profits for outside owners. This helps us keep costs low, so more of our client´s money stays in their pocket—where it belongs.

Notes:

Vanguard is owned by its U.S. mutual funds, which are owned by Vanguard’s fund shareholder clients.

This hypothetical illustration depicts the potential impact of Vanguard's ownership structure. All other factors being equal, Vanguard's ownership structure may allow investors to keep more of their investment returns. The proportions shown do not represent any specific company's actual distribution of returns or percentage operating expenses.

One of the world’s largest asset managers

Our scale and global investment management capabilities position us to give clients worldwide the potential to achieve long-term success.

$12 T AUM*

Total assets under management, Vanguard Group, Inc.

*Source: Vanguard, as of November 30, 2025.

50 M+ Clients*

Investors, The Vanguard Group, Inc.

19 Global offices*

Giving clients worldwide the potential to achieve long-term success.

Note: Diversification does not ensure a profit or protect against a loss.